Discover the world of Hybrid Funds and their remarkable benefits. From understanding the different types to choosing the best one, this guide covers it all. Explore real-life examples, tax implications, and returns. Make informed investment decisions with our expert insights.

Key Takeaways

- Hybrid funds offer a balanced mix of equity and debt, providing growth potential and stability.

- There are various types of hybrid funds, each catering to specific financial goals and risk appetites.

- Taxation of hybrid funds varies based on the asset class and the duration of your investment.

- Returns on hybrid funds may not match those of pure equity funds but provide a more stable investment experience.

- The decision between hybrid and equity funds should align with your specific financial circumstances and objectives. Consulting a financial advisor is advisable to make an informed choice.

Introduction

Table of Contents

ToggleThe mutual fund industry has been on a remarkable trajectory, experiencing significant growth over the years. In fact, as of the latest statistics, the total worldwide assets under management are projected to increase to $145.4 trillion by 2025, underlining the importance of making well-informed investment choices.

Investing your hard-earned money wisely is a priority for most of us. While the stock market and mutual funds have always been popular choices, hybrid funds are increasingly gaining prominence. These versatile investment vehicles offer a blend of safety and growth potential, making them an attractive option for both beginners and seasoned investors.

In this comprehensive guide, we’ll delve into the world of hybrid funds, covering everything you need to know to make informed investment decisions. From understanding what hybrid funds are to exploring different types, examples, taxation, and returns, this guide will be your go-to resource. We will also provide expert insights to help you navigate the world of hybrid funds with confidence.

What are Hybrid Funds?

Hybrid Funds Meaning

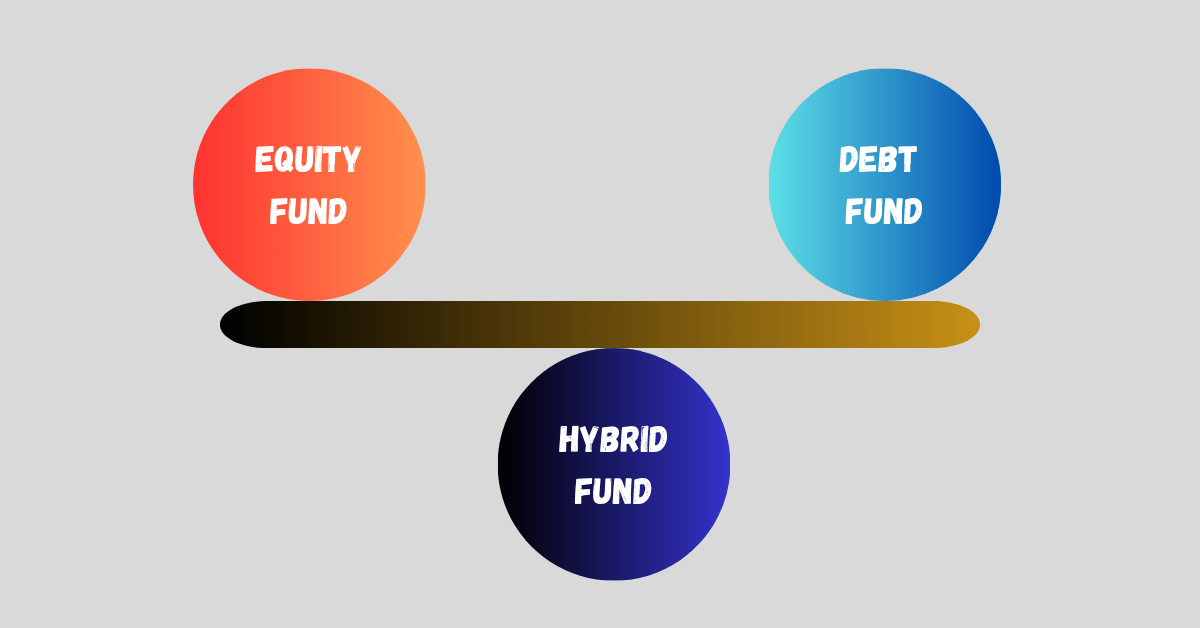

Hybrid funds, as the name suggests, are a hybrid or mix of different asset classes. They combine the characteristics of both equity and debt funds to create a diversified investment portfolio. In simpler terms, these funds invest in a combination of stocks and bonds, and sometimes other assets like cash or gold, to achieve a balanced risk-return profile.

The primary goal of hybrid funds is to offer investors the best of both worlds. They aim to provide capital appreciation through equity exposure and income stability through debt investments. This combination allows investors to enjoy potential growth while reducing the overall risk.

Types of Hybrid Funds

Hybrid Funds Categories

Hybrid funds come in various types, each designed to meet specific financial goals and risk appetites. Here are the most common types of hybrid funds:

- Balanced Funds: These funds maintain a balanced portfolio by investing in both equities and debt instruments. The allocation between equity and debt varies, allowing investors to choose the level of risk they are comfortable with. (Link to Growth Fund)

- Aggressive Hybrid Funds: Formerly known as balanced funds, these are more equity-oriented. They typically invest 65-80% of their assets in equities and the rest in debt instruments, making them suitable for investors seeking moderate growth with a slightly higher risk. (Link to Money Market Funds)

- Conservative Hybrid Funds: These funds are debt-oriented, with a higher allocation to debt instruments (75-90%) and a smaller portion in equities. They are suitable for risk-averse investors looking for stability and regular income. (Link to Mastering Bond Funds)

- Arbitrage Funds: These funds take advantage of price differentials between cash and derivatives markets. They usually invest a substantial portion in arbitrage opportunities and a smaller portion in equity and debt. (Link to Equity Funds)

- Dynamic Asset Allocation Funds: These funds have the flexibility to shift their allocation between equity and debt based on market conditions. The fund manager decides the asset allocation to optimize returns while managing risk. (Link to Comparing Small-Cap vs. Large-Cap Funds)

- Multi-Asset Allocation Funds: These funds go beyond equities and debt and may invest in other asset classes like gold and real estate. They offer diversification across a broader range of assets.

Which type of Hybrid Funds are best?

Choosing the right type of hybrid fund depends on your financial goals, risk tolerance, and investment horizon. Here are some guidelines to help you decide:

- If you are comfortable with moderate risk and seek a balance between growth and stability, balanced funds or aggressive hybrid funds are suitable choices.

- For a more conservative approach with a focus on stability and regular income, consider conservative hybrid funds.

- If you want to take advantage of arbitrage opportunities, arbitrage funds may be the right choice.

- Dynamic asset allocation funds are ideal if you prefer a fund manager to make asset allocation decisions based on market conditions.

- Multi-asset allocation funds are for investors who want a broader diversification beyond just equities and debt.

Hybrid Funds Examples

Let’s look at a couple of hypothetical examples to understand how hybrid funds work in practice:

- Balanced Fund: Suppose you invest in a balanced fund with an asset allocation of 60% in equities and 40% in debt. When the stock market performs well, the equity portion of the fund grows, offering capital appreciation. On the other hand, during market downturns, the debt portion provides stability and income.

- Conservative Hybrid Fund: If you opt for a conservative hybrid fund with 80% in debt and 20% in equities, you will experience less volatility. This is ideal for someone who wants to preserve capital and receive a steady stream of income, making it suitable for retirees.

Hybrid Funds Taxation

Understanding the tax implications of your investments is crucial to maximize your returns. Hybrid funds are subject to taxation based on the type of asset they hold and the duration of your investment.

- Equity Taxation: The equity portion of hybrid funds is treated like equity mutual funds. If you hold your investment for more than one year, it qualifies for long-term capital gains (LTCG) tax, which is currently tax-free up to a certain limit. If you sell it within a year, you’ll be subject to short-term capital gains (STCG) tax.

- Debt Taxation: The debt portion is taxed differently. If you hold your investment for over three years, it falls under the LTCG category and is taxed at a lower rate than short-term capital gains. If you redeem your investment within three years, it’s considered STCG.

- Tax on Dividends: Hybrid funds may distribute dividends, which are subject to dividend distribution tax (DDT). However, DDT is paid by the fund house before distributing the dividend to investors, so you don’t need to pay it separately.

Hybrid Funds Returns

Returns on hybrid funds can vary based on the type of fund and the market conditions. It’s essential to set realistic return expectations, keeping in mind that the primary objective of these funds is to balance risk and return.

- Balanced Funds: Over the long term, balanced funds tend to offer decent returns, often outperforming pure debt funds but with lower risk than pure equity funds.

- Aggressive Hybrid Funds: These funds have the potential to provide better returns than conservative hybrid funds due to their higher equity exposure. However, they can also experience more significant fluctuations.

- Conservative Hybrid Funds: While these funds prioritize stability and regular income, they might offer relatively lower returns compared to other types of hybrid funds.

- Arbitrage Funds: The returns in arbitrage funds are typically lower than pure equity funds. However, they are known for providing consistent and low-risk returns.

- Dynamic Asset Allocation Funds: Returns can vary widely based on the fund manager’s decisions. These funds aim to adapt to market conditions, potentially offering better returns.

- Multi-Asset Allocation Funds: The returns of these funds depend on the performance of various asset classes in the portfolio, which can be more diversified but may not always translate to higher returns.

In the world of investments, patience is key. The returns of hybrid funds may not always be as glamorous as those of pure equity funds, but they provide a level of stability and risk management that appeals to many investors.

Which is better, hybrid or equity fund?

This is a common question for investors. The answer depends on your financial goals and risk tolerance. Here are some considerations to help you decide:

- If you are looking for potential high returns and are comfortable with the associated risk, equity funds may be more suitable.

- On the other hand, if you want a balance between growth and stability, hybrid funds are a better choice, especially if you are risk-averse.

- Diversification in hybrid funds can help manage risk, which might not be possible with equity funds alone.

- If you are a long-term investor, hybrid funds can offer a smoother ride through market ups and downs.

- Investors close to retirement or seeking regular income may find hybrid funds, particularly conservative ones, more appealing.

Ultimately, the decision depends on your financial goals, risk tolerance, and investment horizon. It’s often wise to consult a financial advisor to make an informed choice.

Conclusion

Hybrid funds have emerged as a versatile investment option, catering to a wide range of investors with diverse financial goals and risk appetites. They offer the advantage of a balanced portfolio, combining equity’s growth potential with debt’s stability. Whether you are a cautious investor seeking regular income or a risk-taker aiming for capital appreciation, there’s likely a hybrid fund that suits your needs.

Understanding the different types of hybrid funds, their taxation, and expected returns is crucial to making informed investment decisions. While the choice between hybrid and equity funds depends on your specific circumstances, hybrid funds offer a compelling middle ground for those who want to balance risk and reward.

In this dynamic investment landscape, it’s essential to stay informed, adapt your investment strategy as needed, and consider seeking professional advice. Hybrid funds have undoubtedly earned their place in the world of investments, offering a balanced approach that aligns with the diverse needs of investors. For more insights into various types of mutual funds, check out our article on Mutual Funds 101.

Frequently Asked Questions (FAQs)

1. Are hybrid funds suitable for beginners?

Yes, hybrid funds can be an excellent choice for beginners. They offer a balanced mix of equity and debt, reducing overall risk while providing growth potential. If you’re just starting your investment journey, they can be a great way to ease into the world of mutual funds.

2. How do I choose the right hybrid fund for me?

The choice of a hybrid fund depends on your financial goals, risk tolerance, and investment horizon. Balanced funds are a good starting point, but it’s essential to consult a financial advisor for personalized guidance.

3. Are hybrid funds subject to market fluctuations?

Yes, hybrid funds are affected by market fluctuations, particularly those with higher equity exposure. However, they tend to be less volatile than pure equity funds, providing a degree of stability.

4. Can I switch between different types of hybrid funds?

Yes, most fund houses offer the option to switch between different types of hybrid funds without incurring additional taxes. You can reallocate your investments based on your changing financial goals.

5. What are the tax implications of hybrid funds’ dividends?

Dividends received from hybrid funds are subject to dividend distribution tax (DDT), which is paid by the fund house before distribution. However, this DDT does not affect the investor’s returns directly.

6. What is the ideal investment horizon for hybrid funds?

Hybrid funds are suitable for both short-term and long-term investors. They can cater to various investment horizons, so you can choose one that aligns with your financial goals.